The Nationalization of Mexico’s Oil Industry: A Turning Point

The nationalization of Mexico's oil industry in the 1930s stands as a pivotal moment in the country's history, marking a significant shift in economic control and national identity. This transformative event not only reshaped the landscape of Mexico's energy sector but also set the stage for decades of political and social change. As one of the largest oil producers in the world, Mexico's decision to reclaim ownership of its oil resources from foreign companies resonated throughout the nation and beyond, igniting discussions about sovereignty, economic independence, and the role of natural resources in national development.

As we delve into the historical context leading up to this critical juncture, it becomes clear that the narrative is rich with key figures and events that influenced the trajectory of Mexico's oil industry. The interplay between governmental policies, public sentiment, and economic imperatives paved the way for nationalization, creating a complex tapestry of motivations and consequences. This article will explore not only the process of nationalization itself but also the profound ramifications it had on the Mexican economy, foreign relations, and the global oil market.

Historical Context of Mexico's Oil Industry

The historical context of Mexico's oil industry is essential for understanding the trajectory that led to its nationalization in the mid-20th century. This context is marked by a series of political, economic, and social developments that shaped the extraction and management of oil resources in the country. The timeline of events extends from the early stages of oil exploration to the critical moments leading up to nationalization, which would ultimately redefine Mexico's relationship with its natural resources and foreign powers.

Pre-Nationalization Era

The roots of Mexico's oil industry can be traced back to the late 19th century when oil was first discovered in the country. In 1901, the first significant oil well was drilled in the state of Tamaulipas, marking the beginning of an era that would see Mexico transform into one of the largest oil producers in the world. However, the growth of the oil industry was closely intertwined with foreign investment and influence, primarily from the United States and Britain.

During the early 20th century, the Mexican government actively encouraged foreign investment in the oil sector, leading to the establishment of several oil companies. By the 1920s, companies such as the Mexican Eagle Petroleum Company, which was owned by British interests, and the Standard Oil Company of New Jersey were dominating the market. This foreign dominance raised questions about sovereignty and control over national resources, as local revenues were significantly diminished due to the profits being repatriated abroad.

In addition to foreign control, the labor conditions in the oil fields were notoriously poor. Workers often faced long hours, low wages, and hazardous working environments. The discontent among workers contributed to the growing sentiment against foreign companies, which were seen as exploitative. This period also coincided with the aftermath of the Mexican Revolution (1910-1920), during which nationalistic sentiments surged, and calls for reform grew louder.

The 1930s marked a pivotal decade for Mexico's oil industry. The Great Depression had significant economic repercussions, leading to a decline in oil demand and prices. In response, President Lázaro Cárdenas, who took office in 1934, began implementing a series of reforms aimed at strengthening Mexico's sovereignty over its resources. Cárdenas’s administration sought to promote economic nationalism, which laid the groundwork for the eventual nationalization of the oil industry.

Key Figures and Events Leading to Nationalization

Several key figures and events played crucial roles in the lead-up to the nationalization of Mexico's oil industry. One of the most significant figures was President Lázaro Cárdenas himself, who became a symbol of Mexican nationalism. His government emphasized the importance of controlling natural resources and addressing the grievances of Mexican workers. Cárdenas’s policies included land reforms and the nationalization of the railways, which set a precedent for the oil sector.

In 1938, tensions escalated when the Mexican government expropriated the oil properties of foreign companies, primarily due to ongoing labor disputes and the refusal of foreign companies to recognize the rights of Mexican workers. The expropriation was not just a response to labor issues but also a pushback against the perceived exploitation of Mexico's resources by foreign powers. The decision to nationalize the oil industry was made after a prolonged struggle to negotiate with the foreign companies, which had largely ignored the demands for fair labor practices and local investment.

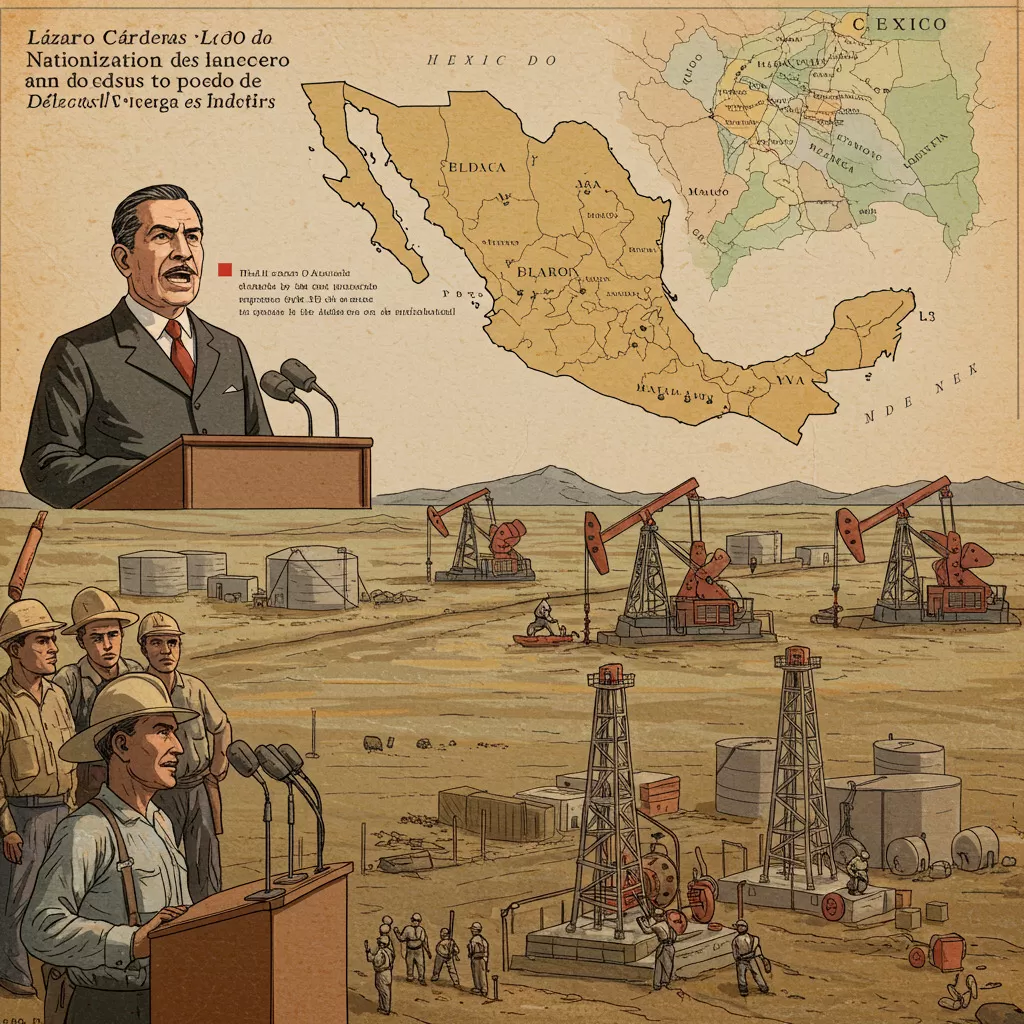

On March 18, 1938, President Cárdenas announced the expropriation of the oil industry in a dramatic speech, stating that the oil would be used for the benefit of the Mexican people. This moment is often referred to as a turning point in Mexican history, as it symbolized a rejection of foreign dominance and a commitment to national sovereignty. The nationalization was met with a mixed response; while it was celebrated among many Mexicans as a victory for nationalism, it also led to diplomatic tensions with the United States and other foreign nations that had vested interests in the oil industry.

In the aftermath of nationalization, the Mexican government faced significant challenges in managing the oil industry. The transition from foreign-managed to state-run operations was fraught with difficulties, including the need to develop infrastructure, hire and train a competent workforce, and establish effective management practices. The government created Petróleos Mexicanos (PEMEX) in 1938, which became the state-owned oil company responsible for all oil production and management in Mexico. The establishment of PEMEX marked a new era in the Mexican oil industry, shifting the focus from profit maximization for foreign investors to investment in national development.

Throughout the 1940s and 1950s, the Mexican government continued to consolidate its control over the oil industry while navigating the complexities of international relations. The aftermath of World War II resulted in a spike in global oil demand, providing Mexico with an opportunity to leverage its oil resources to boost economic growth. The government invested in expanding oil production and refining capacities, aiming to make Mexico a key player in the global oil market.

The nationalization of the oil industry had profound implications for the Mexican economy and society. It represented a significant shift in economic policy, emphasizing self-sufficiency and national pride. Moreover, the move was celebrated by various segments of the population who viewed it as a triumph over foreign exploitation. However, the success of this transition depended on effective management and the ability of the government to balance domestic needs with the pressures of the global oil market.

In summary, the pre-nationalization era of Mexico's oil industry was marked by foreign domination, labor exploitation, and a growing sense of nationalism. The actions of key figures like Lázaro Cárdenas, combined with the socio-political climate of the time, set the stage for the eventual nationalization of the oil sector, which would reshape Mexico's economic landscape and redefine its relationship with natural resources.

The Nationalization Process

The nationalization of Mexico’s oil industry in 1938 marked a pivotal moment in the nation’s history, reflecting a complex interplay of economic, political, and social factors. This process did not occur in isolation; rather, it was the culmination of decades of foreign influence, exploitation, and rising nationalist sentiment. In this section, we will delve into the nationalization process, examining government policies and decisions, public response and social impact, and the economic implications of nationalization.

Government Policies and Decisions

In the early 20th century, Mexico's oil industry was largely controlled by foreign companies, notably British and American firms, which dominated exploration, extraction, and distribution. The Mexican Revolution (1910-1920) had catalyzed a wave of nationalism, leading many Mexicans to view foreign ownership as an affront to national sovereignty. This sentiment intensified as oil became increasingly vital to the nation's economy.

In the 1930s, President Lázaro Cárdenas, who took office in 1934, recognized the need to address the grievances of workers and the public regarding foreign control of natural resources. He initiated a series of reforms aimed at redistributing land and wealth, but it was the oil industry that became the focal point of his administration's policies. Cárdenas sought to assert Mexican sovereignty over oil resources and rectify the power imbalance created by foreign corporations.

On March 18, 1938, Cárdenas announced the nationalization of the oil industry, stating that the government would expropriate the assets of foreign oil companies. This decision was based on the belief that the oil industry should serve the Mexican people and contribute to national development rather than profit foreign investors. The government justified the move by citing the failure of foreign companies to comply with labor laws and their reluctance to invest in infrastructure and development in Mexico.

The expropriation was formalized through a series of decrees that established the state-owned oil company, Petróleos Mexicanos (PEMEX). The creation of PEMEX was not just a means to control oil resources; it was also a symbol of Mexican nationalism and self-determination. The government promised to compensate the foreign companies, although the negotiations over the amount and terms of compensation became contentious and prolonged.

Public Response and Social Impact

The announcement of nationalization was met with widespread enthusiasm and support among the Mexican populace. Many viewed it as a triumph of national sovereignty over foreign exploitation. Trade unions and workers' organizations celebrated the move, as they believed it would lead to better working conditions and increased wages in the oil sector. The government’s decision resonated with the revolutionary ideals that had inspired the Mexican Revolution two decades earlier.

However, the nationalization also sparked significant opposition, particularly from the foreign companies affected by the expropriation. The United States government expressed concern over the potential for similar actions affecting American investments in Latin America, leading to diplomatic tensions. The oil companies launched a campaign to discredit the Mexican government, arguing that the nationalization would lead to inefficiency and corruption in the oil industry.

Despite this opposition, the nationalization process catalyzed a sense of pride and unity among Mexicans. The government’s efforts to promote national oil production were accompanied by campaigns to educate the public about the importance of oil for national development. Cárdenas emphasized that oil revenues would be reinvested into the country, funding infrastructure projects, education, and social programs. This approach helped to solidify public support for the nationalization, as many began to see the direct benefits of the government’s policies.

Economic Implications of Nationalization

The economic implications of nationalizing the oil industry were profound and far-reaching. Initially, the government faced significant challenges in managing the oil sector, which had been dominated by foreign companies for decades. The transition to a state-run entity required not only the development of new management structures but also the training of a workforce that had previously been reliant on foreign expertise.

In the short term, the nationalization led to a decrease in oil production due to disruptions and the need to reorganize operations. However, as PEMEX began to stabilize, production levels gradually increased. The government focused on reinvesting oil revenues into the national economy, which helped to stimulate other sectors and promote economic growth. The oil industry became a crucial source of revenue for the Mexican state, contributing to infrastructure projects and social programs aimed at improving living standards.

Moreover, the nationalization of oil had significant implications for Mexico's international relations. It marked a shift in the balance of power between Mexico and foreign investors, particularly the United States. The U.S. government initially responded with economic sanctions and diplomatic pressure, fearing that the nationalization could inspire similar movements in other Latin American countries. However, as Mexico's oil production stabilized and began to flourish, the U.S. had to reassess its approach to Mexico, recognizing the importance of maintaining a cooperative relationship with its southern neighbor.

Over the years, PEMEX became one of the largest oil producers in the world, and the revenues generated from oil sales funded various development projects across the country. The nationalization process also paved the way for Mexico to explore other natural resources, fostering a sense of economic independence and resilience.

However, the nationalization also brought challenges that persisted long after the initial expropriation. While oil revenues contributed to economic growth, they also created an over-reliance on oil exports, leading to vulnerabilities in times of fluctuating oil prices. The government faced criticism for not diversifying the economy and for allowing PEMEX to become a source of political patronage and inefficiency.

Summary of the Nationalization Process

The nationalization process of Mexico’s oil industry was a defining moment that shaped the country’s economic, social, and political landscape. It represented a triumph of nationalism and self-determination in the face of foreign domination. Through government policies and decisive actions, the Mexican state reclaimed control over its natural resources, fostering a sense of pride and unity among its citizens.

While the immediate challenges of nationalization included managing the transition from foreign to national control and addressing international backlash, the long-term effects included a significant increase in oil production and revenue that fueled national development. However, the legacy of nationalization also brought about challenges, including economic dependence on oil and issues of inefficiency within PEMEX.

The nationalization of Mexico's oil industry remains a crucial chapter in the country’s history, illustrating the complexities of resource management, national sovereignty, and the dynamics of global economic relations.

| Aspect | Details |

|---|---|

| Date of Nationalization | March 18, 1938 |

| President | Lázaro Cárdenas |

| State-owned Company | Petróleos Mexicanos (PEMEX) |

| Economic Impact | Increased national revenue, infrastructure development, and economic growth |

| Long-term Challenges | Dependency on oil revenues, inefficiencies within PEMEX |

Consequences of Nationalization for Mexico

The nationalization of Mexico's oil industry in 1938 marked a pivotal moment in the country's economic and political history. This move, spearheaded by President Lázaro Cárdenas, was not merely an act of seizing control over natural resources; it represented a broader socio-political transformation. The consequences of this decision reverberated through the decades, influencing the oil market landscape, foreign investments, and long-term economic outcomes. Understanding these consequences requires an exploration of various dimensions, including changes in the oil market, effects on international relations, and the enduring economic challenges faced by the nation.

Changes in the Oil Market Landscape

The nationalization of the oil industry fundamentally reshaped Mexico's oil market, transitioning it from a landscape dominated by foreign companies to one where the state assumed full control. The creation of Petróleos Mexicanos (PEMEX) not only centralized oil production but also altered the dynamics of the industry and the economy.

Prior to nationalization, foreign companies, particularly American and British firms, controlled the majority of oil production in Mexico. This dominance often led to conflicts over resource allocation, profit distribution, and labor rights. With the establishment of PEMEX, Mexico sought to ensure that oil revenues would benefit the nation directly, channeling funds toward public services and infrastructure development.

As a result, the state became the sole entity responsible for exploration, production, and distribution of oil. This shift allowed Mexico to assert its sovereignty over its natural resources, fostering a sense of national pride and identity. In the subsequent decades, PEMEX became a vital source of revenue for the government, contributing significantly to national budgets. By the 1970s, oil revenues accounted for a substantial portion of Mexico's GDP, enabling the government to finance various social programs and development initiatives.

Effects on Foreign Investments and Relations

The nationalization of the oil industry had profound implications for foreign investments and Mexico's relations with other countries, particularly those with vested interests in the oil sector. The immediate aftermath of nationalization saw tensions rise, particularly with the United States and Britain, two nations that had heavily invested in Mexico’s oil infrastructure. The seizure of foreign assets without compensation led to diplomatic disputes and economic repercussions.

In reaction to nationalization, the United States imposed economic sanctions, which had a chilling effect on foreign direct investment in Mexico. U.S. oil companies, which had previously enjoyed lucrative contracts and a strong presence in the Mexican market, faced significant losses. This situation forced Mexico to navigate a complex diplomatic landscape, as the government sought to reassure foreign investors while maintaining its commitment to national sovereignty.

Over time, Mexico's relationship with foreign investors evolved. The government adopted policies that allowed for limited foreign participation in the oil sector without relinquishing control. This approach aimed to attract foreign capital and technology while ensuring that the state retained a significant stake in oil production. The 1990s saw a gradual opening of the energy sector, marked by reforms that encouraged private investment in exploration and production.

Despite these changes, the legacy of nationalization continued to influence foreign perceptions of Mexico. While many investors were drawn back to the market, concerns over regulatory stability and government intervention persisted. This cautious approach impacted Mexico's ability to leverage its oil resources fully, as foreign companies remained wary of potential state interventions.

Long-term Economic Outcomes and Challenges

The long-term economic outcomes of the nationalization of Mexico's oil industry are multifaceted, characterized by both successes and ongoing challenges. On one hand, the state control of oil resources provided the government with significant revenue streams that facilitated economic growth and development. On the other hand, the reliance on oil revenues created vulnerabilities that would surface in later years.

In the years following nationalization, Mexico experienced considerable economic growth fueled by oil revenues. The government invested heavily in infrastructure, education, and healthcare, improving the overall quality of life for many citizens. Additionally, PEMEX emerged as a key player in the global oil market, positioning Mexico as one of the largest oil producers in the world. This growth spurred the development of related industries, such as refining and transportation, further diversifying the economy.

However, the dependence on oil revenues also led to significant economic challenges. The volatility of oil prices on the global market exposed Mexico to economic shocks. When oil prices fell in the 1980s, the country faced a severe economic crisis characterized by inflation, devaluation, and rising debt levels. The government's reliance on oil revenues meant that economic downturns were felt acutely, prompting calls for economic diversification and reform.

In response to these challenges, successive governments have attempted to reform the energy sector to reduce dependence on oil. The 2013 energy reform sought to attract foreign investment and expertise back into the sector, allowing private companies to participate in oil production and exploration. While this move aimed to modernize the industry and increase efficiency, it also reignited debates over national sovereignty and the role of foreign entities in Mexico's natural resources.

| Economic Impact | Consequences |

|---|---|

| Revenue Generation | Significant contributions to national budget and social programs. |

| Infrastructure Development | Investment in transportation, healthcare, and education. |

| Economic Volatility | Susceptibility to global oil price fluctuations and economic crises. |

| Foreign Investment Challenges | Initial withdrawal of foreign investment due to nationalization; gradual reopening of the sector. |

The complex legacy of the nationalization of Mexico's oil industry highlights the intricate balance between state control, economic growth, and foreign relations. While the move was initially celebrated as a triumph of national sovereignty, the ensuing decades revealed the challenges inherent in relying heavily on a single resource for economic stability. The evolution of Mexico's oil sector continues to reflect broader themes of national identity, economic strategy, and the interplay between domestic policies and global market forces.